Our Content

Research-driven builders and investors in the cybernetic economy

We contributed to Lido DAO, P2P.org, =nil; Foundation, DRPC, Neutron and invested into 150+ projects

The Supercycle Is Here. Just Not the One You Were Promised.

The Great Divergence

The hardest pill to swallow for this cycle is that the "rising tide lifts all boats" era is over. In previous cycles, you could throw a dart at CoinMarketCap and make money. Today, we are seeing a big split.

Most crypto assets are effectively heading to zero. Your favorite memecoin, the thousands of governance tokens, "ETH-killers," and vaporware projects from the last cycle will never rediscover their all-time highs. They are zombies. The market has matured and investors have smartened up. Capital is no longer chasing whitepapers, and turning to projects with real cash flow and revenue.

The only assets that will grow are those that have cemented themselves as critical infrastructure – like Ethereum and Solana – or those generating undeniable fees and revenue. Everything else is noise.

The Steady Adoption

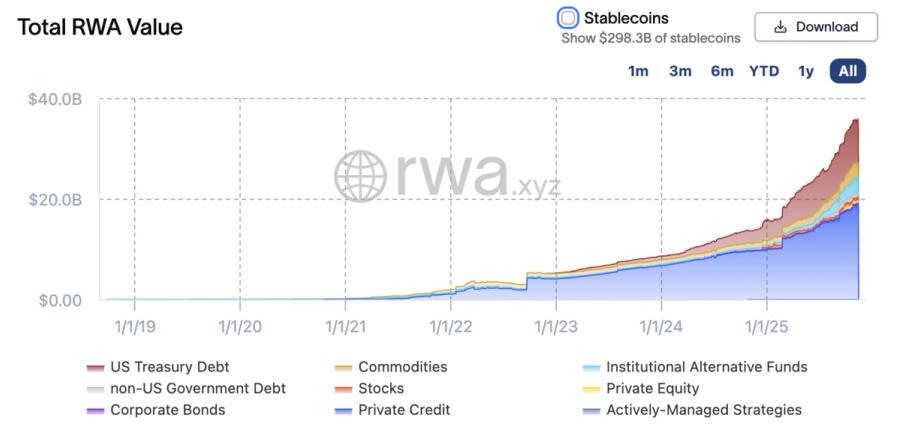

While price speculators are bored, the backend of the global financial system is being rewired. Adoption hasn’t stopped.

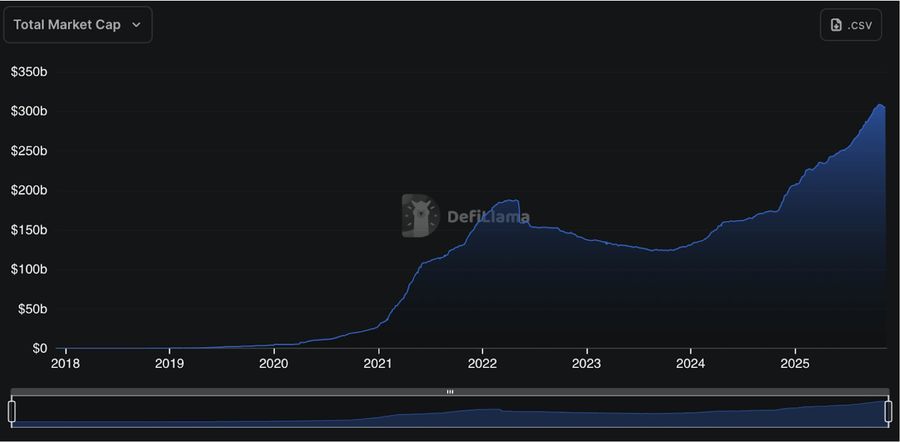

For years, regulation was the industry's boogeyman. Today, it is finally unlocked. The regulatory clarity emerging in 2024 and 2025 has given the green light to the giants we used to view as enemies. Stablecoin supply breaks ATH everyday, and it is unstoppable.

Neobanks are becoming crypto-native banking layers.Visa and Mastercard are integrating stablecoin settlement directly into their rails:

- Visa is processing billions of Stablecoin volume that powers next generation Neobanks

- Mastercard acquired ZeroHash

- Stripe is going all-in on payments through stablecoins

- CashApp integrated USDC payments in their front end

- Revolut integrated zero fee stablecoin conversion

They all realized that to survive, they had to co-opt the technology rather than fight it. This integration creates a sticky, unstoppable floor of demand – one that doesn’t show up in speculative order books but exists in fundamental transaction volume.

The Yield Rotation

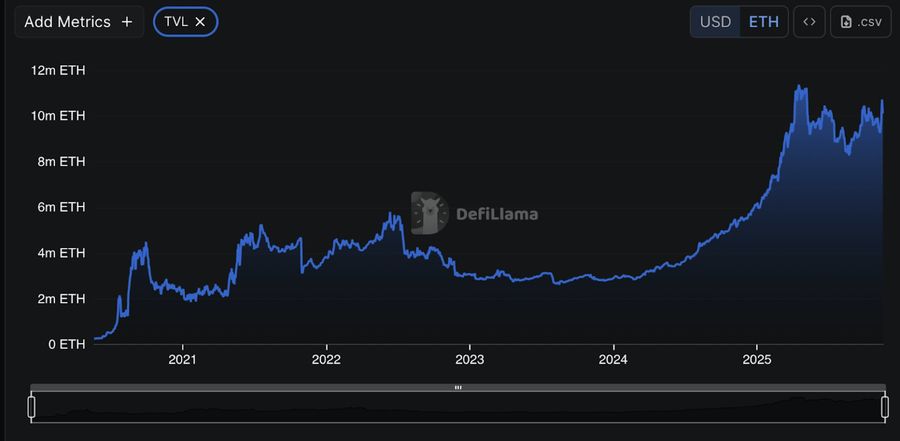

Macroeconomics is finally playing into our hands. As the Federal Reserve cuts rates and ends QT, the "easy" 4% risk-free yield on US Treasuries is evaporating. And that capital cannot sit idle.

We are about to see a massive rotation back onchain. But this time, it isn't flowing into Ponzi schemes; it will flow into DeFi protocols that generate real yield from trading fees and lending. As traditional rates fall, DeFi yields become the only game in town for productive capital. As a result we already see ATH in AAVE TVL.

Next-gen DeFi & The AI Economy

Crypto rails are being utilized by new financial primitives that are finally finding product-market fit. Derivatives and perps initially found PMF with degens, but now are expanding as liquid, onchain hedging environments for institutions. Prediction markets have morphed from niche experiments into reliable sources of global truth: Google integrates Polymarket, Kalshi partners with NBA.

But the ultimate catalyst – the one that makes this Supercycle truly unstoppable – is AI.

We are building a world of AI agents. These agents will not walk into a Chase bank to open a checking account. They will spin up a wallet. They will transact, swap, and pay for compute resources using crypto. They will generate new auction markets on the fly, based on the users’ intents.

Blockchains will be the native substrate of the cybernetic economy, on top of which AI agents will coordinate & transact.

The Upshot: Return to Fundamentals

We are in the Supercycle. It just looks different from the euphoria of 2021. It is quiet, structural, and ruthless. The prices of useless assets will continue to bleed, but the integration of crypto into the global economy is unstoppable.

We have hit escape velocity. You just need to look at the right charts to see it.