Our Content

Research-driven builders and investors in the cybernetic economy

We contributed to Lido DAO, P2P.org, =nil; Foundation, DRPC, Neutron and invested into 150+ projects

The MVI Grants Program

Konstantin Lomashuk and Artem Kotelskiy

Feb 5, 2024Attention Ethereum community!

Changing the issuance curve is a really important decision: we must carefully analyze and discuss the implications, because at stake is Ethereum’s core value – Decentralization.

Summary:

1. Agree with the EF researchers that the key is the staking ratio2. Disagree with the proposed ¼ target value, b/c MVI impact on staking economy is not studied 3. Present a basic analysis, suggesting that the proposed MVI hurts solo & decentralized actors much more than the centralized ones4. Paint a realistic scenario, where @coinbase controls >51% of ETH staked5. Suggest that a further careful study of the MVI impact is required6. Announce a $500k grants program from cyber•Fund for economists and researchers to explore and analyze this problem in-depth

Addressing the conflict of interests:

While we hold ETH, LDO and are involved with P2P, our goal is to not push MVI into a favorable direction. Instead we wish to spotlight this issue, offer a perspective from the staking economy, and ultimately call for a more careful approach.

1. Background and our position

First of all, thank you Ethereum Foundation and Anders Elowsson for your deep research on MVI. We agree that the key variable to analyze is the target “staking ratio” = the portion of circulating ETH staked.

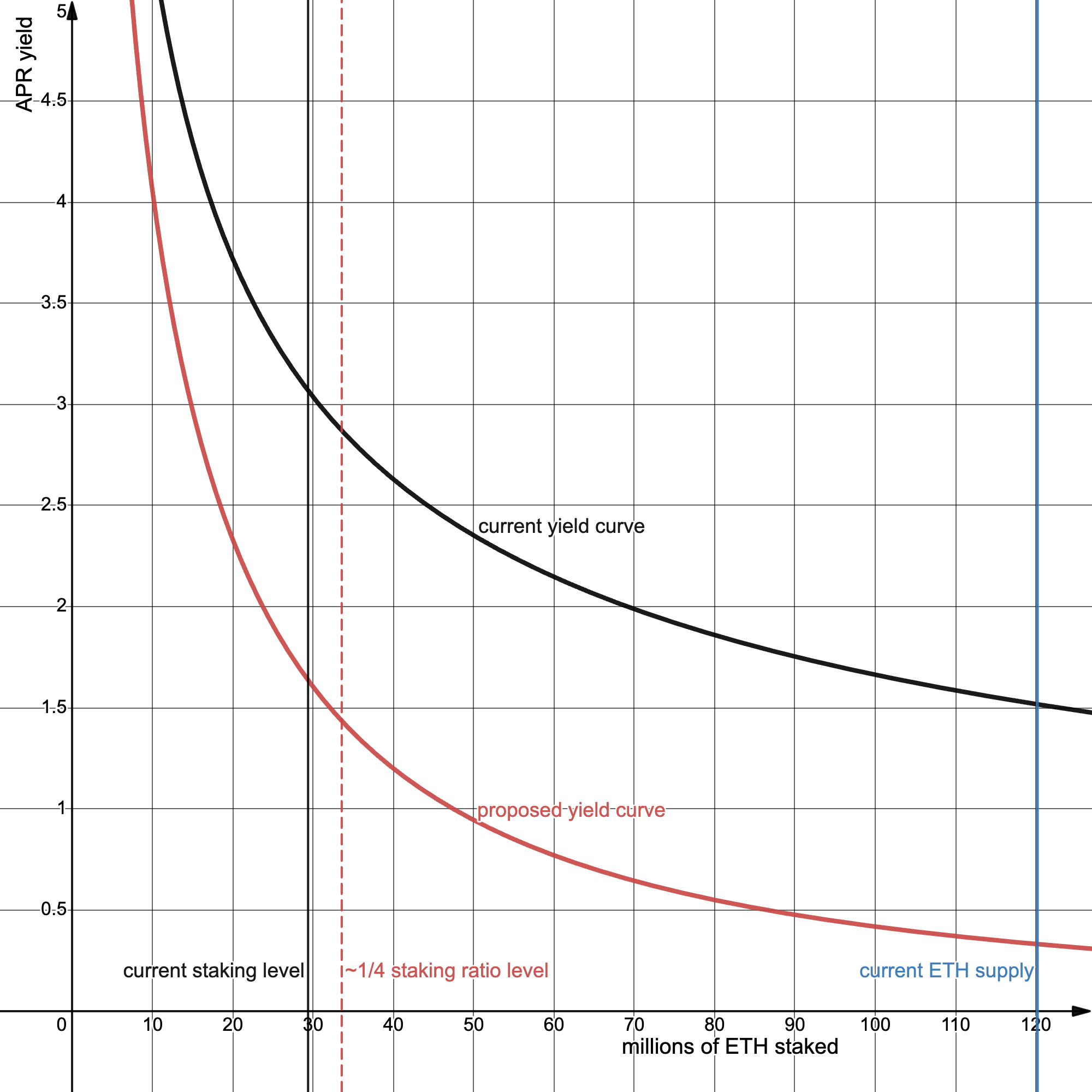

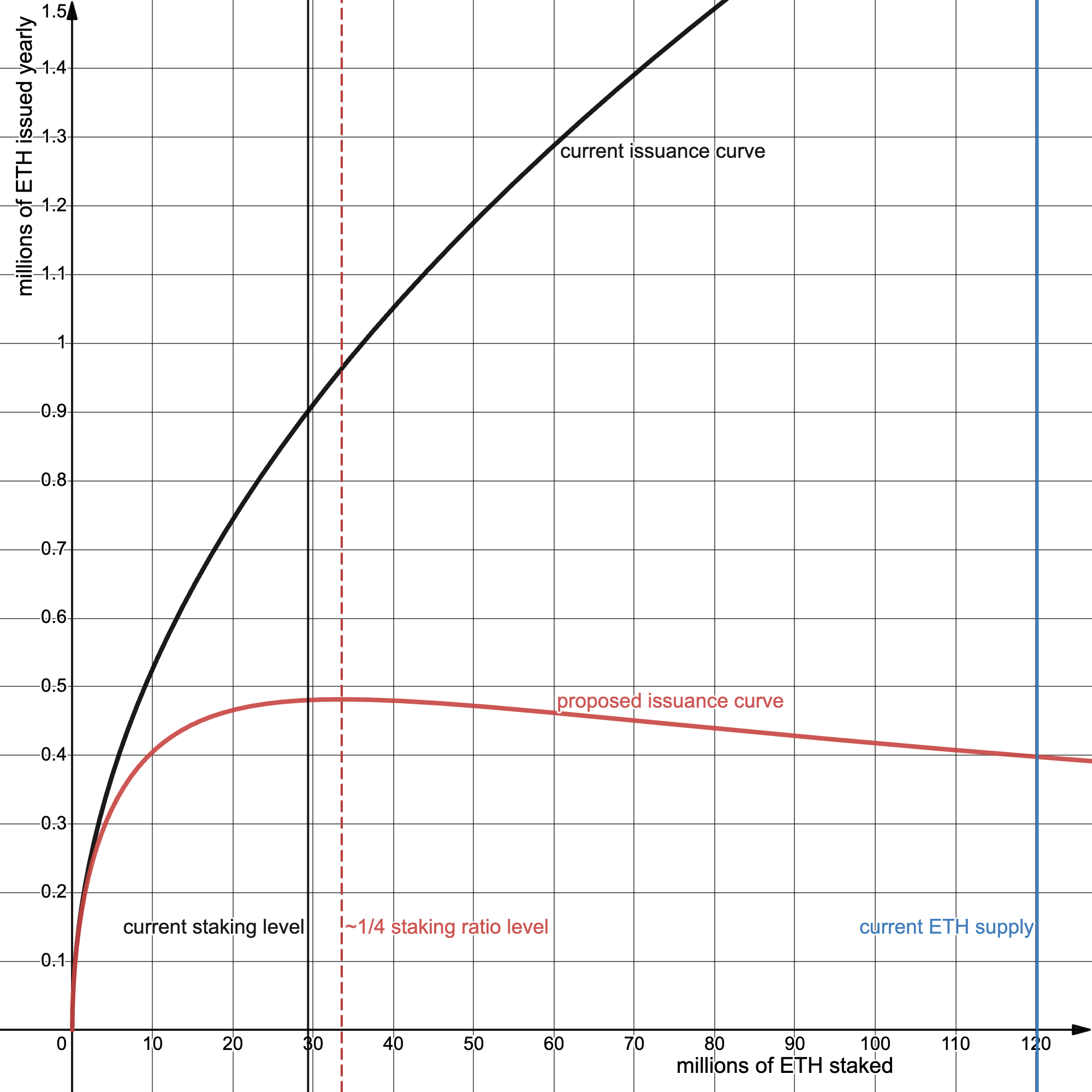

In your recent studies [1, 2] you focus on the impact the staking ratio has on economic security, consensus incentives and reward variability. In Section 5.5 you suggest an issuance yield curve with the following properties:

- It halves the current issuance yield at the ¼ staking ratio – see the first picture below;

- It decreases in such a way that the yearly ETH issuance peaks exactly at the ¼ level – see the second picture below.

You thus suggest that approximately ¼ of ETH staked should be the target. However, we think the analysis is incomplete: staking ratio impact is much wider and stronger, in particular on the staking economy.

Today we have roughly the following players in the staking economy: - Exchanges and future ETF custodians: Coinbase, Binance - Professional staking providers: Figment, P2P, etc - Decentralized solutions: Lido, RocketPool - Innovations like DVT: Obol, SSV - Solo stakers

Let’s do a basic analysis of the impact of changing the MVI policy on these players. The goal is to showcase how *changing MVI can hurt solo & decentralized actors much more than the centralized ones*.

2. Impact on exchanges, custodians and centralized staking providers: low

The market clearly shows that staking mostly works through delegation, be it offchain or onchain. And delegation has inherent centralizing pressures: it is much easier & cheaper to spin up a centralized staking solution, rather than a decentralized one.

What this means is that issuance policy will not affect the centralized pools, but may affect the decentralized ones. In practice, ETFs already hold >3% of BTC. This will continue to grow, and the picture will look similar for ETH.

More concretely, as of Q3 2023 Coinbase already stakes ~4.3m ETH and custodies a further ~13.4m. So now Coinbase custodies ~15% of all ETH in circulation, and with the growth of ETFs (serviced mainly by Coinbase) this figure could well increase to 25%.

Keeping in mind that Coinbase Custody, Coinbase Prime and future ETF-related ETH will be staked long-term due to market forces, it’s likely more than half of those 25% custodied ETH will be staked. i.e. Coinbase ALONE could end up staking >⅛ of ALL ether in circulation.

Thus, if under MVI we target ¼ staking ratio, there is a realistic scenario where Coinbase controls more than half of all staked ETH. Furthermore, two more centralized Coinbase competitors could together reach the ⅛ level, so three players will control the whole staking market.

Therefore, targeting ¼ staking ratio will exert immense pressure on the long-tail of solo stakers & decentralized staking providers, destroying decentralization.

3. Impact on decentralized pools, solo stakers and innovations: high

Here the impact of lower issuance is twofold: 3a. It increases costs (relative to gains) 3b. It increases barriers to innovation

3a. Decentralized staking solutions have significant coordination costs and can become unprofitable to run: - Custodians capture the market by having low costs and thus no incentive to unstake - As the staking ratio approaches ¼ the emissions will be low and decreasing

For solo stakers the effect is similar, exacerbated by the absence of economies of scale & the high variance of MEV rewards. (And the sunk fixed hardware costs are unlikely to stop solo stakers from withdrawing if the yield drops too low.)

More generally, as the network approaches the target staking ratio, organic appetite for staker participation follows different curves depending on the profile. CEXes can still afford to enter, while smaller staking orgs / dec pools / solo stakers cannot.

So the effect is that the smaller players will drop out with a few stragglers, and the larger players will asymptotically saturate the market towards complete dominance.

3b. From the innovation perspective, frequent MVI changes make starting projects like Obol and SSV much riskier, because they invest capital and resources based on certain conditions, and changing those conditions can disrupt their business plans. So the risk is less innovation.

Furthermore, we know how to build staking pools that are even more decentralized than the status quo, but it requires more innovation on the technology. Halving staking rewards now & decreasing them further will take away the free-market incentives for this innovation to happen.

Bottom line, we are looking at the following potential scenario: - Coinbase stakes more than ⅛ of ETH - Two more centralized providers can have ⅛ of ETH together - Their costs are low and they captured all the market (if staking ratio target = ¼) - No innovations/improvements

So far we’ve focused on the staking economy. But there are many other aspects and effects of MVI: cultural, security, reputational, legal, indirect, etc. Ethereum is a tech platform that at its core enables social coordination, and so it's vital to examine all these factors.

To conclude, we suggest that a careful analysis is required, focused on the dynamic *lower issuance→tougher conditions in staking economy→centralization of staked ETH* and its impact on decentralization Ethereum. Restaking & other factors should also be taken into account.

To this end, we are announcing a $500k grants program from cyber•Fund. We invite economists and other researchers to explore and analyze the broader effects of MVI on the staking economy and its decentralization.

To apply for a grant, please email your background and research plan to [email protected], or directly contact the grants selection committee members: @artofkot, @eliasimos

To reiterate: we call for more attention, discussion and research on MVI. This work is essential to do before making an issuance curve change, because it can affect the decentralization of Ethereum significantly. Let’s do it together!