Research-driven builders and investors in the cybernetic economy

We contributed to Lido DAO, P2P.org, =nil; Foundation, DRPC, Neutron and invested into 150+ projects

Mellow – The rails for onchain Capital Allocators

Dogan Alpaslan and Konstantin Lomashuk

Nov 5, 2025A new class of institutional curators is entering the space, seeking programmable, transparent, and scalable yields that DeFi uniquely enables. Today, we are proud to announce our lead investment in Mellow, a project that’s building the rails for a new class of onchain curators – professionals who combine DeFi-native strategy design with institutional-grade standards, security, and compliance.

1. Onchain Yields Go Institutional

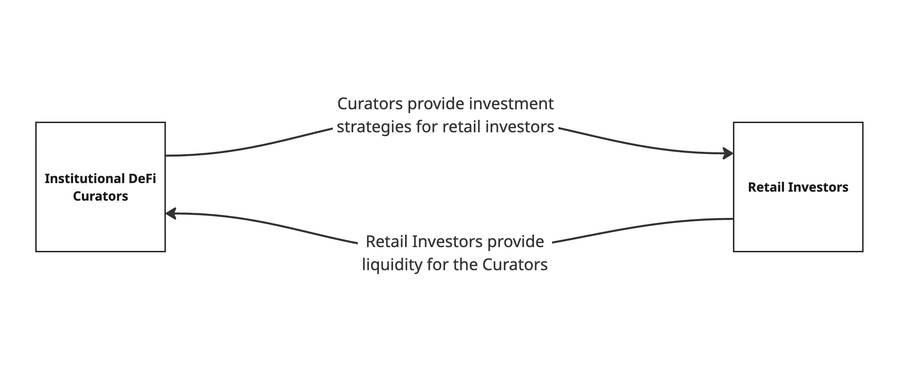

Institutional curators are moving onchain, drawn by the programmable yields, transparent operations, and composability that DeFi enables. These actors bring capital, compliance needs, and professional standards. Most importantly, institutions are also keen to manage retail capital, and users are ready to provide liquidity in exchange for access to high-quality, risk-managed strategies.

What we’re seeing is a flywheel forming:

Yet there’s a fundamental issue: the infrastructure gap.

2. Curators Need Infrastructure

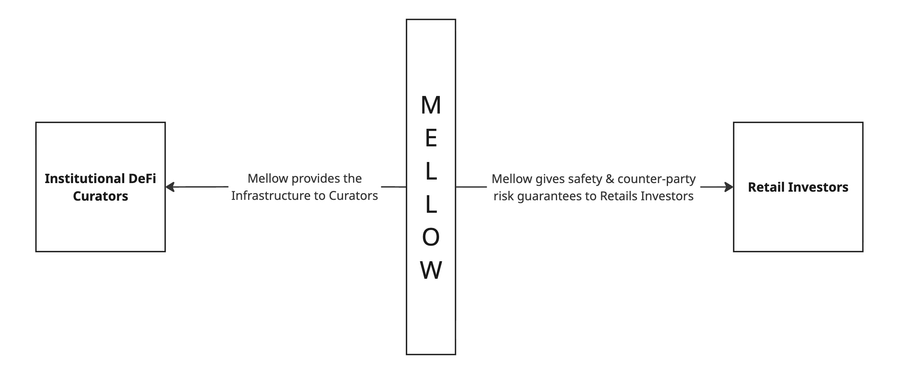

Curators are not protocol developers: they can design sophisticated strategies, but don’t want to spend months building vault logic, security layers, queuing systems, UI/UX, or whitelisting tools. They need a system that handles:

- Strategy execution across chains and protocols

- Risk management and compliance

- Capital onboarding (retail + institutional)

- Monitoring, permissions, and liquidation protection

- Distribution and go-to-market

And perhaps most importantly: user trust. Liquidity providers want protection from mismanagement, rug pulls, and complex interfaces. They want curated access to sophisticated DeFi strategies with clear terms and transparency.

3. Enter Mellow: Infrastructure for Curated Onchain Asset Management

Mellow is a vault framework built for institutional DeFi curators.

With Mellow, curators can deploy complex strategies from delta-neutral CEX positions to leveraged restaking and multi-protocol yield loops, all without touching smart contract infrastructure. Mellow features include:

- Modular vault architecture

- Multi-vault orchestration

- Compliance-ready controls and whitelists

- Automated leverage tools (LoopKit)

- Active AMM management (ALMKit)

- Secure integrations with CEXes and DeFi protocols

- Institutional onboarding with Lido, Flow Traders, and >50 node operators

As a result, Curators can focus on strategies, while Mellow handles the rest.

On the team front, Mellow has 16 full-time members who include ICPC finalists, security engineers, and ex-fintech execs. They are DeFi OGs that have been relentlessly grinding for several years, shipping dozens of secure vaults, and currently managinge over $450M in TVL today.

4. The paradigm shift towards distribution & curation

The market is shifting, and institutions are already onchain: Stripe is building their own chain, Coinbase & Revolut are integrating yield, Robinhood is building on Arbitrum, Lido V3 is pushing stETH into ETFs — all enabling superior yields that are not accessible in TradFi.

As a result we see a clear shift of moats towards distribution. And for crypto-native teams competing head-on with channel-owners is the wrong fight. Instead, new players win by providing modular infrastructure that plugs into existing rails. That’s why curated markets are rising: protocols supply building blocks, while fintechs and institutions bring them to millions – all through curators' packaged strategies, managed risk and tailored approach.

DeFi curators are becoming the dominant path to scale, and Mellow is powering this shift. Having already onboarded leading crypto-native curators and validator networks, they are now expanding into more traditional fintech and institutional channels.If you are an Asset Manager, Curator, Liquid Fund or any other Institution – now is the right time to launch your onchain strategy with Mellow.