Research-driven builders and investors in the cybernetic economy

We contributed to Lido DAO, P2P.org, =nil; Foundation, DRPC, Neutron and invested into 150+ projects

Stablecoins Beyond the US Dollar

Stablecoins have clearly found a strong product–market fit with the US Dollar. The reason is straightforward: the USD is the most widely accepted currency globally, and people seek easy, programmable, and censorship-resistant access to it.

Yet the world is much bigger than the USD. Currencies like the Euro, Chinese Yuan, and Japanese Yen have deep exposure in traditional finance, but very few of them have gained meaningful adoption as stablecoins. Each local market has its own mix of structural and regulatory reasons behind this.

In this post, I look at where local stablecoins actually make sense, and how they could help open up FX markets onchain.

Why Local Stablecoins Have Struggled

Most local stablecoins have failed to find their GTM for two primary reasons.

- Macroeconomic Incentives — In economies with high inflation or unstable monetary policy, users have little incentive to hold the local currency, on- or off-chain. A digital wrapper around a depreciating unit does not solve the underlying issue of value erosion.

- Liquidity and Network Effects — Local stablecoins face a “cold-start” or coordination problem. Without sufficient on-chain liquidity, users and merchants have no reason to adopt the stablecoin; but without users, market makers cannot justify providing deep liquidity. This cold start issue makes bootstrapping adoption difficult.

Nevertheless, this does not imply local stablecoins lack long-term potential. When designed with the right incentives and open-market structures, they could serve as bridges for foreign-exchange (FX) flows, domestic payment settlement, and cross-border liquidity access, areas still constrained by traditional financial infrastructure. But how?

Unbundling the Entry point

Let’s discuss how a user can get access to the onchain world.

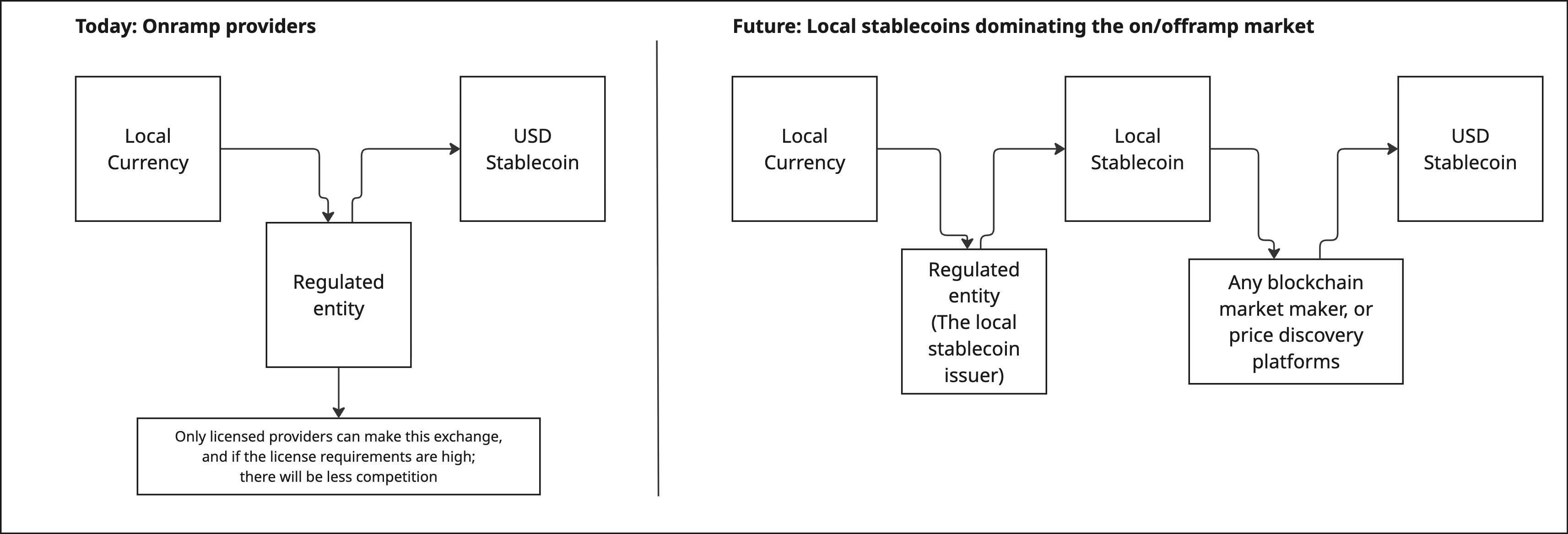

The first and most traditional path is this: a user goes to an onramp or an orchestrator, gives their local currency, and the onramp provider returns a USD stablecoin. It is simple but depends on a regulated entity, which brings operational restrictions and limits how market making can work.

The second path emerges with local stablecoins. Here, the user already holds a local currency, for example Turkish Lira or BRL, and interacts directly with a local stablecoin issuer to mint its onchain version. The conversion from the local stablecoin to a USD stablecoin then happens entirely on blockchain-based products. This structure only requires one regulated entity to handle issuance, while the price discovery happens onchain

Let’s now analyze the new market structure, and how local stablecoins unlock sustainable value creation & moat.

The Open Market Thesis

Today’s on- and off-ramp providers, typically licensed payment institutions or exchanges, operate in a tightly regulated but highly competitive market. Their competitive advantage lies mainly in pricing and distribution, not in technological differentiation. As a result, their margins and moats are thin.

A well-designed local stablecoin, on the other hand, pushes the open and permissionless competition to the market making level. Instead of a few custodians or exchanges setting prices, liquidity provision becomes an open activity, governed by transparent algorithms and decentralized mechanisms.This is the core idea:

Local stablecoins can transform FX and payment access into open markets.

By allowing users to convert fiat 1:1 into an onchain equivalent, a local stablecoin effectively opens the domestic currency to global liquidity. Once on-chain, these tokens can be exchanged freely via global market makers in CEXs, automated market makers (AMMs), central limit order books (CLOBs), or aggregators, the same infrastructure that already handles billions in daily volume for USD-based assets.

This transition represents a structural improvement in market efficiency:

- Disintermediation — Market making becomes accessible to anyone with capital and algorithmic capability, not just locally licensed institutions.

- Onchain Price Discovery — On-chain liquidity pools reveal real-time exchange rates, compressing spreads and improving price efficiency.

- Reduced Frictions — With a single mint/burn API and standardized compliance (KYC/AML), liquidity provision becomes modular and scalable.

The strong moats of Local Stablecoins

While local stablecoins push away the competition for FX rates, they can focus on capturing the monetary network effects. Once a major local stablecoin issuer starts to dominate the market, its main moat will be liquidity and AML capabilities, as more users begin to use its product.

The local stablecoin issuer’s role is minimal but crucial:

- Maintain a simple API for minting and redemption.

- Comply with local regulatory requirements and AML;

- Align incentives for market makers (via rebates, yield programs, or treasury operations).

As these mechanisms mature, liquidity deepens, FX spreads compress, and price discovery becomes globally competitive. The outcome is a more efficient market for the local currency, enabled by the power-law winner in the local stablecoin market. We won’t need any other on and offramps anymore, a single local stablecoin could be enough to handle everything, with commoditized on/off ramp providers under the hood.

If you are building a local stablecoin, especially one focused on efficiency, interoperability, and open access, we’d love to talk. We believe local stablecoins will capture a significant share of the FX and fiat-on/off-ramp market, and that this transformation will be driven by open, competitive market structures rather than by regulatory privilege alone.