Our Team

Research-driven builders and investors in the cybernetic economy

We contributed to Lido DAO, P2P.org, =nil; Foundation, DRPC, Neutron and invested into 150+ projects

Ethereum Thesis — Root Chain for the World Computer

Konstantin Lomashuk and Artem Kotelskiy

May 30, 2025

In this piece we analyze Ethereum’s trajectory, and present a variety of arguments & theses — the ones that explain why we are in love with Ethereum and cannot stop contributing to it ❤️.

1. Introduction

We first invested in Ethereum in 2014, based on the vision of shared & trustless compute layer. Ethereum has realized this vision, by building the first smart contract platform, powered by a permissionless and decentralized set of nodes.

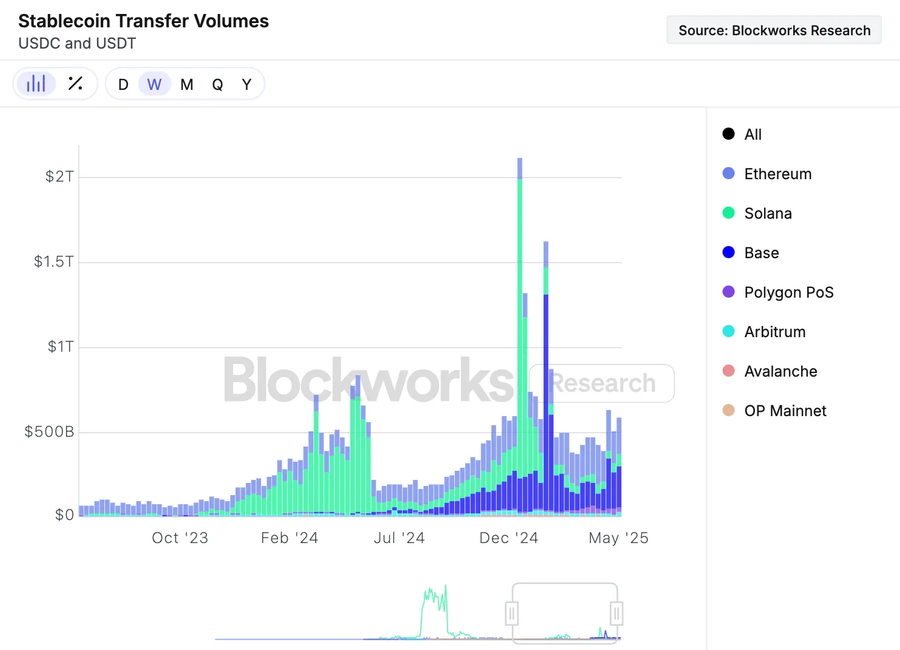

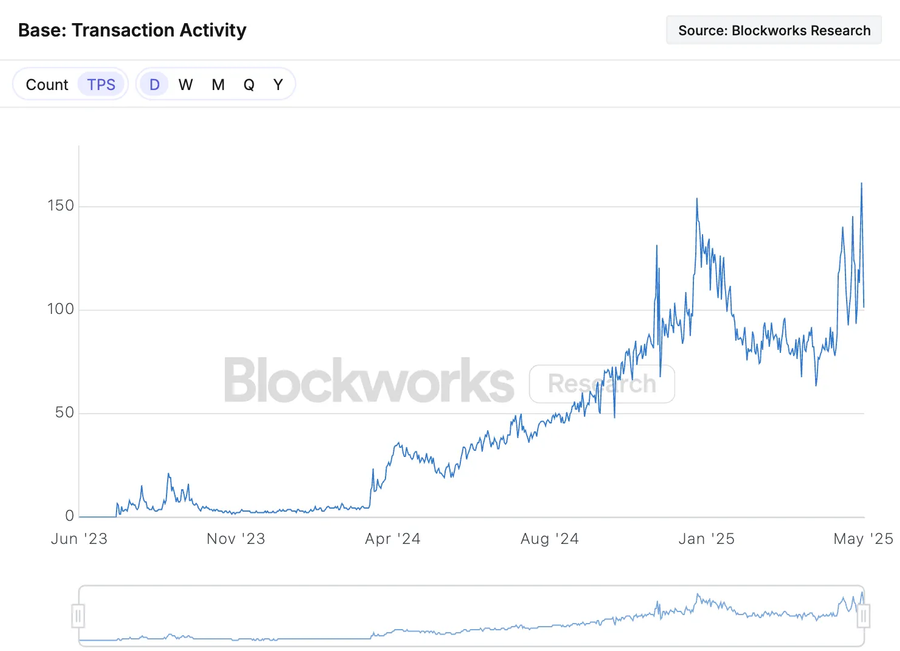

Today Ethereum, with its highest level of decentralization and stability, is emerging as the leader in the blockspace market — particularly as the foundational infrastructure for the Decentralized Finance (DeFi) sector, as well as the neutral Schelling point platform for applications, businesses and institutions. With World Chain rollup serving over 25M million users, Base processing over 40% of weekly $0.5T stablecoin volume, and payment providers such as Stripe and Visa adopting these rails, the exponential adoption of Ethereum as the base layer has only just begun.

Ethereum’s strategy to facilitate this growth—while widely debated—has in fact been right: offering cheap, abundant and secure blobspace in order to unconditionally win all the valuable customers. And the future path for acceleration is clear: Ethereum will scale L1 to cement it as the capital of DeFi, and solve the cross-rollup interoperobility issue in order to build a liquidity moat for DA. As a result, rollups will have the lowest risk-adjusted transaction cost and the highest liquidity premium — and hence the market will push all execution towards Ethereum DA, paving the way for Ethereum to become the root chain of the World Computer.

Underpinning this thesis are several key factors.

Security first. While its decentralized nature made Ethereum slow and expensive, this initial trade-off proved to be immensely valuable, because it allowed Ethereum to become the most secure and reliable public compute platform. It stands out by having the largest and most active research & developer community, and by prioritizing censorship resistance & neutrality through decentralization. These security-oriented Ethereum values were instrumental to the emergence of DeFi; they also cultivate trust between Ethereum and users, developers, businesses — and this trust builds a strong moat over time.

On a broader level, there is a variety of aspects driving the product-market fit of the neutral public blockspace: interoperable open standards, code & operation persistence, co-ownership and transparent operation of the underlying infrastructure, increase in financial sovereignty, and the resulting reduction of intermediaries. Fundamentally, shared compute enables coordination between users and programs, on a previously unprecedented level of efficiency.

Scaling today. From the very beginning we had realized that blockchains would need to scale by orders of magnitude — something that is evident today.

Ethereum’s approach to the scalability trilemma is unique: having first achieved the highest level of decentralization, now the tech (zkEVM and PeerDAS) is ready for Ethereum to scale the blockspace without compromising on security—both vertically via L1 to 10k TPS, and horizontally via DA to 1M TPS. The most scale will eventually come from rollups— channel partners that drive user acquisition— capturing the high-velocity markets such as payments, trading, AI-to-AI coordination, social, etc. With rollups being the best form-factor for existing businesses to come onchain, Ethereum will gradually transform into a root chain that secures the whole world public compute, allowing it to escape competition and survive the future disruptive tech-innovation cycles.

Network effects. In the highly dynamic & competitive space of technological networks, the optimal business strategy is not to extract maximum value short-term — instead Ethereum should offer superior product (blockspace) at cheap prices to continue winning all the valuable customers (applications and businesses). Simultaneously, and critically, Ethereum should strive to lock those customers in by building strong moats coming from security, liquidity and composability network effects.

Importantly, Ethereum is in the process of expanding these network effects from L1 to all the rollups, by actively solving the rollup interoperobility issue. As a result, hundreds of rollups will not only settle on Ethereum — they will use and pay for Ethereum DA, in order to tap into L1 security and economy, i.e. benefit from the trust and liquidity network effects.

Interestingly, the key amplifying factor behind the liquidity network effects is the security of Ethereum DA and rollups’ validating bridges. The recent bright idea of native rollups reinforces execution guarantees and rollup security, hence bolstering both trust and liquidity network effects. These rock solid security assurances are the core underlying reasons for why businesses & institutions will continue to gravitate towards building on Ethereum.

Value Accrual. Eventually, after the market consolidation through network effects plays out, Ethereum will achieve strong market power and accrue significant value — potentially captured by an appropriate “minimal-price” tweak of the EIP-1559 mechanism described in Section 9. This will be the foundation for the valuation of ETH the asset. The monetary and speculative premiums, bolstered by the naturally emerging Ethereum L2 economy, will propel ETH into the status of money — money in the global cybereconomy.

We have been building & investing on top of Ethereum for 10 years, because we truly believe in the vision of permissionless, horizontal coordination. We have gradually increased our initial ETH ownership by more than tenfold. Ethereum is our highest conviction bet, and below we lay out in detail the cyber•Fund Ethereum thesis.

2. The DeFi PMF

In Sections 2-5 we analyze Ethereum’s trajectory, while in Sections 6-9 we discuss Ethereum’s future business strategy and go into the details of our thesis.

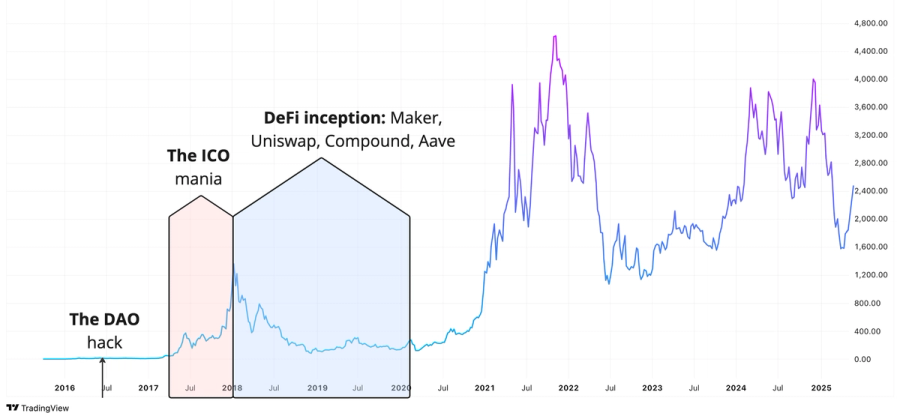

Figure 1: ETH price, major historical phases

After Ethereum's 2015 launch, the 2016 DAO hack, and the 2017 ICO boom, the 2018–2020 bear market was particularly formative. Ethereum emerged as an ideal execution environment for DeFi: transparent, permissionless, self-custodial and highly interoperable financial infrastructure. DeFi unlocked token issuance via the ERC20 standard, trading via Uniswap, decentralized stablecoins like DAI from Maker, and lending via money markets like AAVE & Compound. After the legendary 2020 DeFi summer, the PMF was undeniable — see the blue TVL graph below.

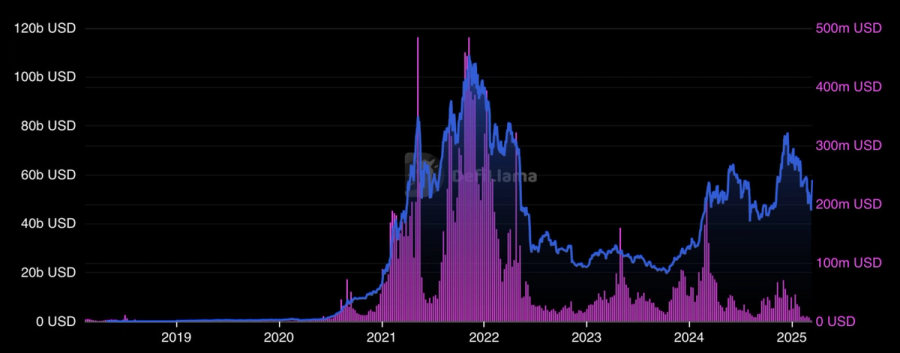

Figure 2: Ethereum TVL in blue, weekly fees in pink

The graph above also shows how surging DeFi demand drove significant revenue to Ethereum, with congestion fees hitting several hundred dollars for a single transaction at prime times. This fact played out in two major ways for Ethereum: on the one hand, from the asset viewpoint, it meant that ETH the asset could start accruing value. On the other hand, from the network viewpoint, high fees clearly exposed scalability as the key challenge for Ethereum (and for any other blockchain as well).

3. The ultrasound arc of ETH: EIP-1559 and The Merge

From the protocol economics perspective, the two most important upgrades in Ethereum history have been EIP-1559 in Summer 2021 and the transition to Proof-of-Stake (”The Merge") in Fall 2022.

EIP-1559 was a fee mechanism redesign, which addressed the problem of determining gas price via inefficient priority gas auctions. Instead, 1559 enabled Ethereum network to quote the price of transaction inclusion via a base fee.

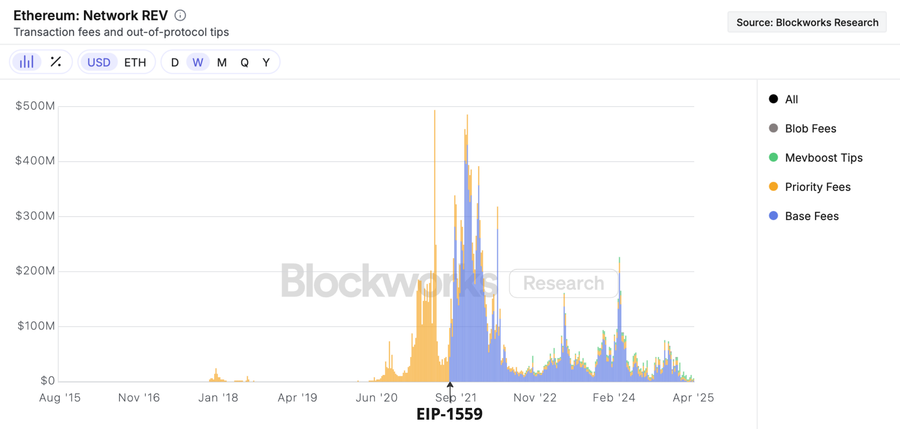

The primary and successfully achieved goal of 1559 was to reduce gas price volatility and to make the blockspace market more predictable. Additionally, the upgrade introduced the first direct value accrual mechanism for ETH, through burning all the base fees paid by Ethereum users. This started a constant downward pressure on ETH supply, which is equivalent to redistributing base fees to all token holders. Below in purple is the portion of the weekly fees that started accruing to ETH holders, starting in August 2021.

Figure 3: EIP-1559 impact on ETH value accrual

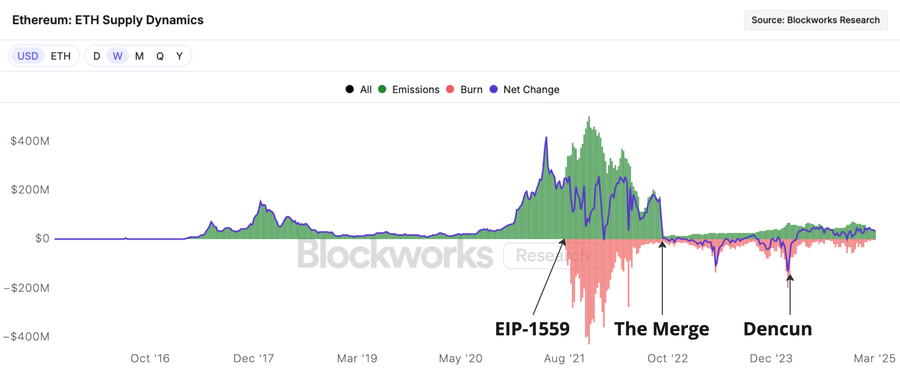

After ETH started receiving strong deflationary pressure from 1559, the attention turned to the costs side, namely the issuance rate of ETH. To that end, in September 2022, Ethereum upgraded the critical part of its consensus mechanism—Sybil resistance—from Proof-of-Work to Proof-of-Stake. The scope and difficulty of that hardfork were enormous. After The Merge was successfully carried out, Ethereum became 8000x more energy efficient, and the annual issuance required to reward the nodes securing the network (formerly miners, now validators) dropped from over 4% to less than 1%. This drastic change in issuance is illustrated below in green, through weekly ETH emissions.

Figure 4: Weekly ETH emissions in green, ETH burn in orange, net difference in blue

Motivated by Bitcoin’s sound money narrative, which refers to its supply being bounded by 21 million, ETH the asset was dubbed ultrasound money due to its potential for decreasing supply. And indeed, observing the blue graph above, we see that for about a year ETH's aggregate supply was deflationary. This changed in March 2024, coinciding with the Dencun upgrade which introduced the concept of blobspace — more on this later.

4. The scaling challenge arc of Ethereum: Rollups

While scalability has been an active research topic since the beginning of Ethereum, consistently high network fees after 2020 made it absolutely clear — scaling is the core technical challenge of Ethereum. At the heart of it is the decentralization↔performance trade-off: naively increasing the gas limit (aka block size) leads to an increased load on the nodes maintaining the network. This increased load leads to higher node hardware requirements, which in turn leads to a more centralized validator set, and a potential loss of the ability to verify the chain on consumer hardware.

Unlike many other L1s, to uphold censorship resistance and neutrality—core Ethereum value propositions—the community relentlessly researched scaling solutions that would not centralize the network. Major scalability bottlenecks include re-execution of all transactions by all nodes, blockchain state growth, and sequentiality of execution in the EVM. Nowadays, after years of R&D, there are known solution to these problems: history expiry and statelessness for state growth, access lists allowing parallelization for sequentiality, delayed execution and zkEVM (with real-time proving) for re-execution.These upgrades provide roughly 100-1000x boost in throughput. Critically, however, back in 2020 all these ideas were very nascent, unproven and too far out in the future. Whereas Ethereum needed a concrete practical short-term scaling solution.

Sharding was the first sound and natural proposal put forward. In parallel, various “Layer 2” type solutions had been in active development, such as payment channels and plasma. The constant experimentation with L2 solutions eventually led to the bright idea of rollups — that transactions can be stored on Ethereum, but not re-executed by all nodes — instead, the state transition function can be be validated either via SNARKs, or optimistically (with challenges & fraud proofs addressing Byzantine faults). This approach started to gain serious interest, because rollups can operate under a weak 1-of-N trust assumption on their validator set:

- Rollups achieve Ethereum-level safety through the validating bridge smart contract;

- Rollups achieve Ethereum-level liveness & censorship resistance through the escape hatch mechanism;

- Rollups solve their data availability problem by posting transactions to a special sharded data layer on Ethereum.

Eventually, due to (a) the complexity of sharding of execution; (b) the relative simplicity of the data-only sharding (aka danksharding); and (c) traction of rollup scaling solutions, the community converged on a difficult decision to shard only the data layer and let execution be handled by rollups.

The resulting rollup-centric roadmap is the most important and controversial bet Ethereum has made — to this day it is being vigorously discussed. To understand why, we start with analysis of the value flows.

Figure 5: Value flows before and after rollups

Pre-rollups, Ethereum’s business model was simple — Ethereum sold blockspace in exchange for transaction fees. Post-rollups however, the model became more complicated: there were now three parts to the value flow, and below we look at the current state of each.

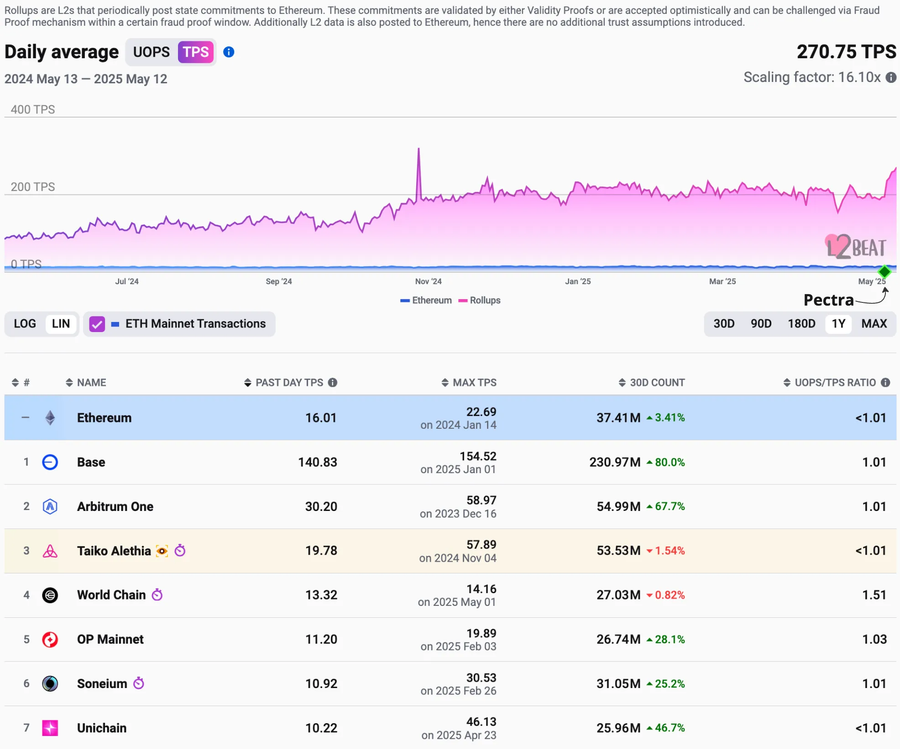

(1) Users → Rollups. From the user adoption perspective, rollups have been quite successful: they are processing ~250 TPS in total, while L1 processes 16 TPS. The TVL growth has also been strong and comparable to Ethereum L1.

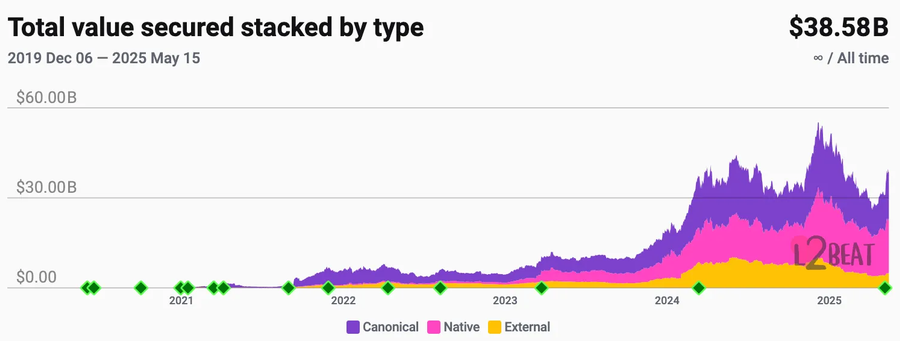

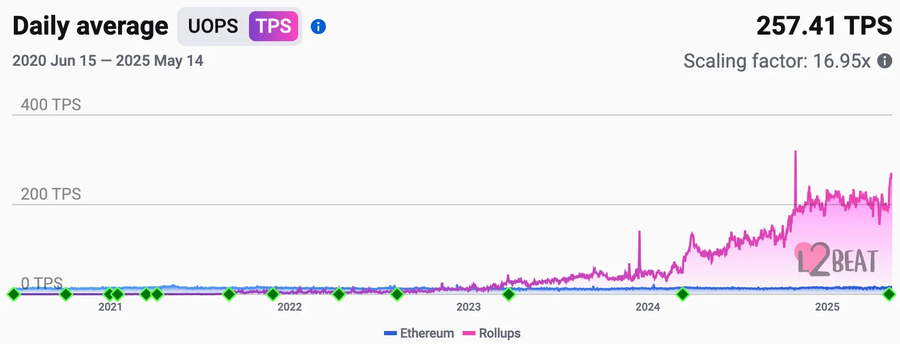

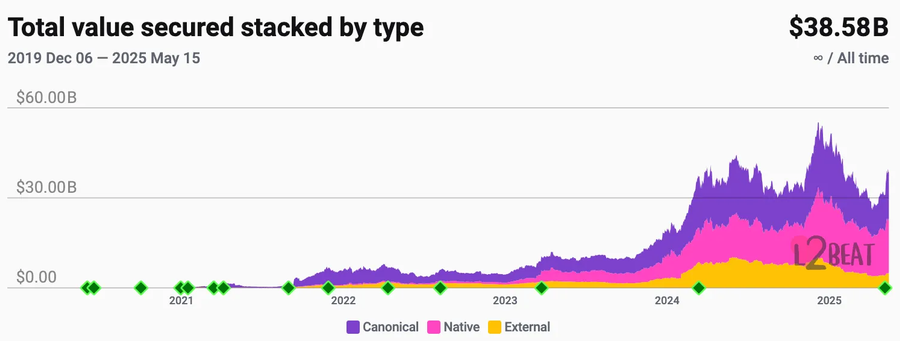

Figure 6a: the aggregate TPS metric of rollups. Note: Ethereum L1 recent TPS is 16.

Figure 6b: the aggregate TVL on rollups. Note: recent TVL on Ethereum L1 is $60B.

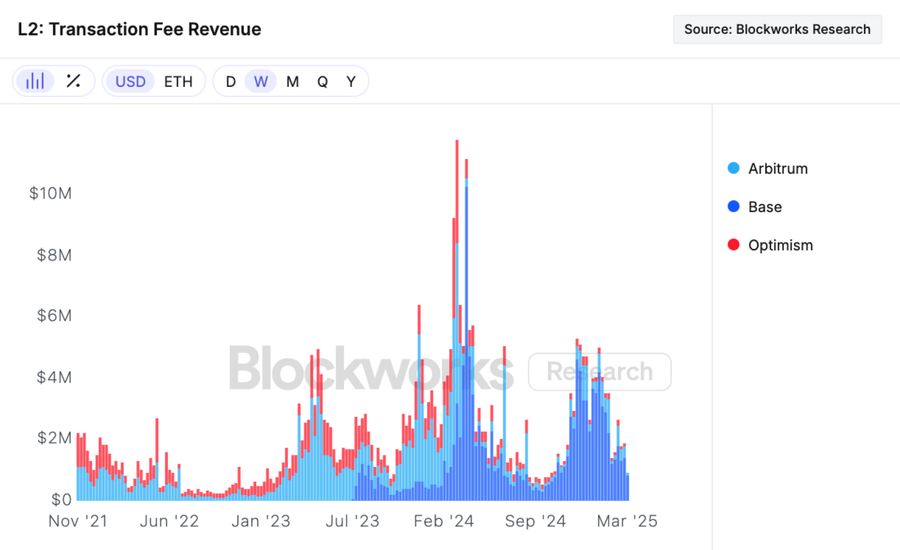

On the revenue side, top rollups earn millions per week.

Figure 7: Weekly fees of Arbitrum, Base and Optimisim.

In practice, Base (Coinbase’s rollup processing over >40% of weekly $0.5T onchain stablecoin volume — see Figure 18 below), World Chain (Worldcoin’s rollup serving over 10 million unique humans), Arbitrum ($13B TVL rollup with an active grassroots DeFi ecosystem), Optimism, Unichain, Starknet, zkSync, Linea, Scroll, Taiko, Soneium (Sony’s rollup), Ink (Kraken’s rollup) and many others are becoming great channel partners, helping Ethereum onboard users and expand the blockspace market.

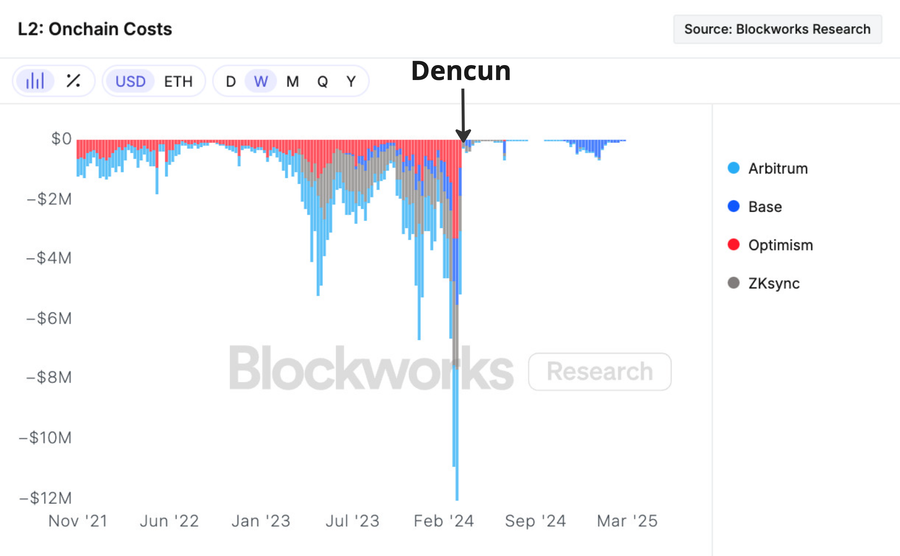

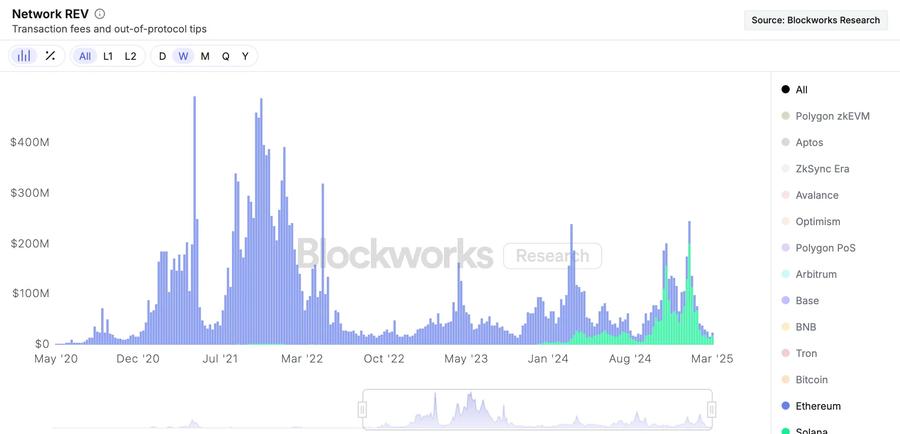

(2) Rollups → Ethereum. Figure 7 above shows that rollups have earned a fair amount of fees by reselling blockspace, and the natural question is how much of that value they are passing to Ethereum.

Figure 8: Rollups’ onchain costs, and their drop post-Dencun

We see above that since March 2024 rollups drastically reduced the value that they pass back to the L1 via direct onchain costs — this is why many nowadays call rollups parasitic. The reason for the sharp drop in rollups’ onchain costs was the Dencun upgrade, in which Ethereum effectively separated its 1559 fee market into two: one for L1 execution layer blockspace, and one for blobspace (the data availability layer).

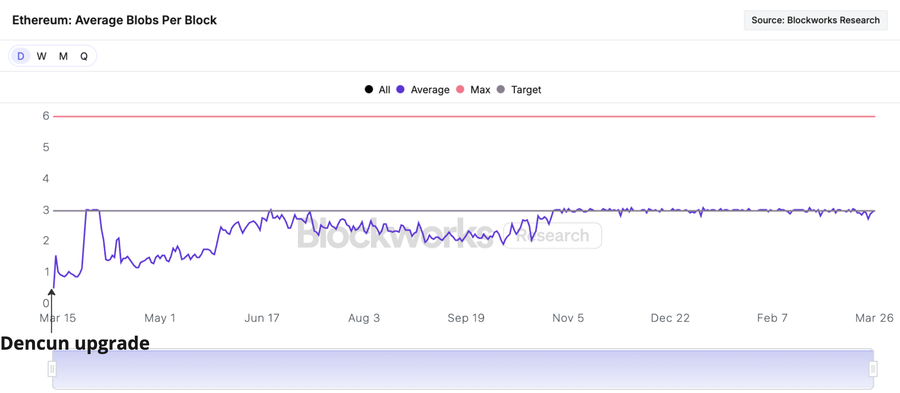

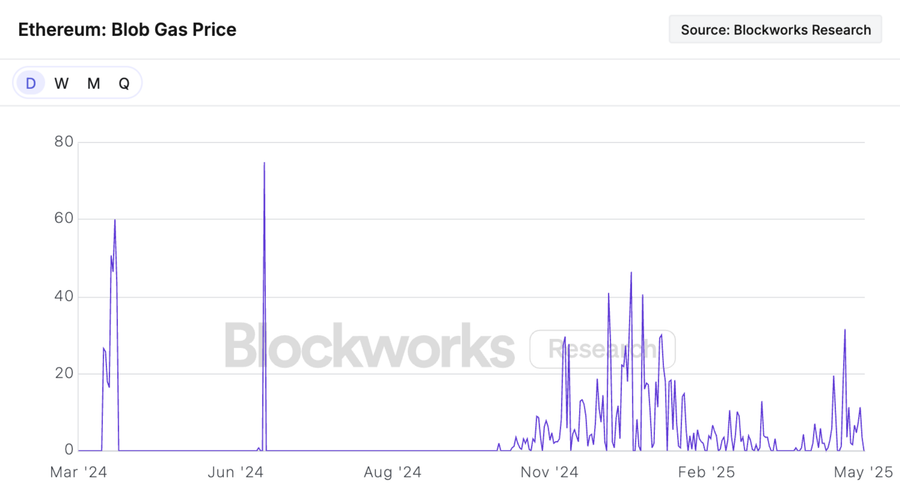

As a result, rollups stopped posting transactions to Ethereum L1 calldata, and started posting them to the blobspace. This meant that rollups’ transactions no longer competed with regular L1 transactions. And it turned out that, with the same underlying EIP-1559 fee mechanism, the target capacity of 3 blobs per block was bigger than the demand (see Figure 9 below), and as a result the blobspace fees remained nearly 0 until November 2024, and are still low (see Figure 10 below).

Figure 9: Daily average number of blobs per block

Figure 10: Daily average blob gas price in gwei, i.e. the cost to store bytes on Ethereum DA

(3) Users → Ethereum L1. From the L1 blockspace supply viewpoint, the rollup-centric roadmap technically did not affect the L1 execution. However, demand for L1 blockspace decreased, and there are many possible explanations to it, which we analyze in the next section.

Recently however, it has been suggested and recognized by many that maintaining and scaling L1 is an important part of the roadmap. The argument being that today the L1 scaling R&D is sufficiently advanced to allow for 100-1000x scaling over 4-6 years, and hence we should reap the benefits of that, while L2s should be used to provide complementary capacity and customized experiences that the L1 cannot achieve, such as ultra-fast finality, blocktimes, specific VMs, sequencing etc.

Accordingly, the gas limit has been recently raised from 30m target to 36m, and upon the recent Pectra upgrade a further raise to 60m is in the process. Furthemore, a suggestion to continuously increase 100x gas limit over 4 year was put forward as an EIP-7938, with a clear motivation and discussion. And the timeline may accelerate given recent advancement in real-time proving.

5. Ethereum metrics today: the crisis and the underlying factors

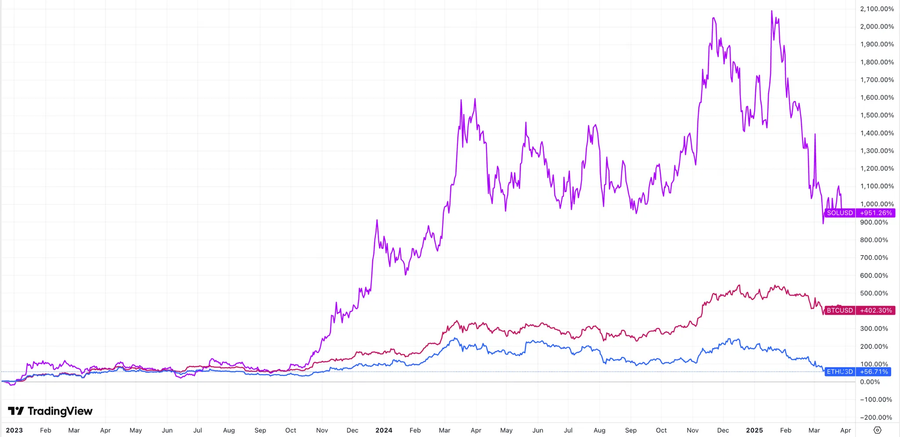

Since the FTX collapse in November 2022, crypto industry as a whole saw steady growth, but ETH has significantly underperformed the other two major blockchain assets, BTC and SOL:

Figure 11: Relative performance of ETH, BTC & SOL

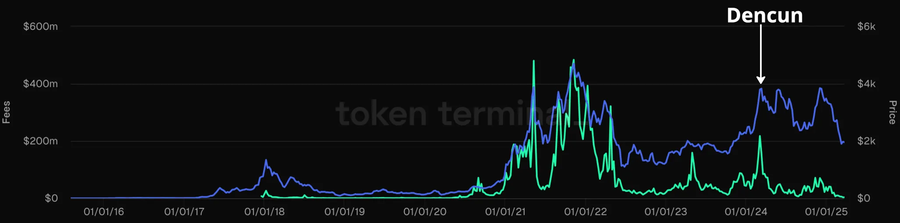

Naturally, ETH price performance is well correlated to Ethereum networks’ fees:

Figure 12: Graph of Ethereum’s weekly fees (green) and ETH price (blue)

And since 2022, Ethereum networks’ fees (currently primarily coming from blockspace, rather than blobspace) have not increased substantially, both in comparison with Ethereum’s fees in the previous 2018-2022 cycle, as well as in comparison with Solana’s fees this cycle:

Figure 13: Ethereum vs Solana weekly fee comparison

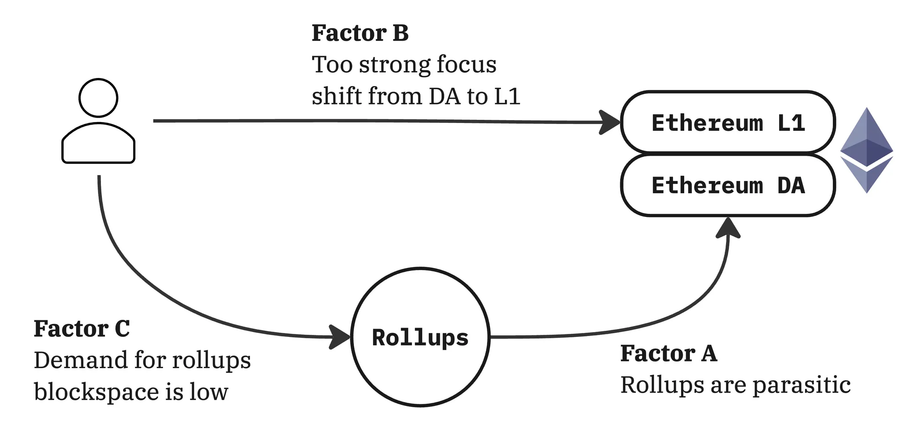

Let us now discuss the possible factors causing Ethereum’s revenue underperformance — interestingly, zooming in on each part of of the value flows from Figure 5 offers a possible explanation.

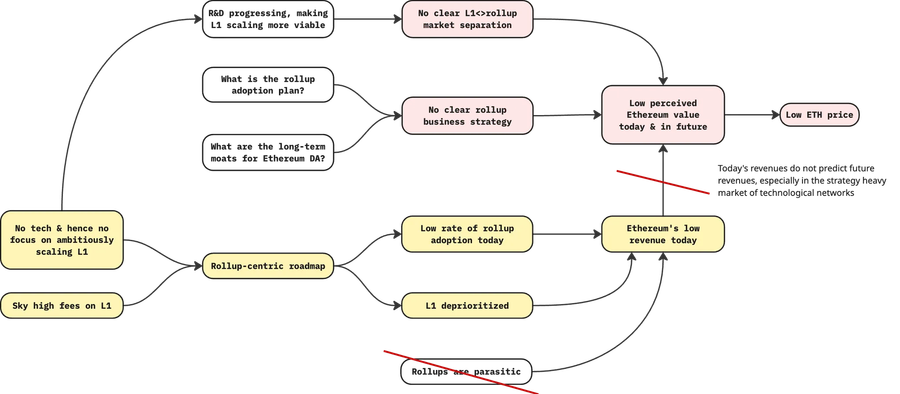

Figure 14: Factors potentially responsible for Ethereum’s underperformance

Factor A. Rollups are parasitic. While earning fees from users, rollups do not pass much of the value to Ethereum.

The magnitude of this factor is negligible, even though it is factually true. Rollups’ revenues are in single millions per week so far. These revenues are low partially because rollup sequencers can handle much higher gas limits than Ethereum’s network of validators (see the TPS graph in Figure 6a), and hence rollups do not need to charge users as much as L1 networks do. Thus, even if rollups passed the majority of fees to Ethereum, it wouldn’t make much of a difference.

More importantly, it is way too early to call out rollups for not passing the value to Ethereum. In fact, at this stage damping the DA market by offering blobs for free and attracting as many rollups as possible is the right strategy, and it is ironic that it was executed “accidentally” by Ethereum community — more on this in the next couple sections.

Factor B. Too strong of a shift of focus from L1 to DA. Post-rollups, Ethereum’s strategy and user growth has been focused on rollups, neglecting the growth and maintenance of L1.

This factor is partially correct — Ethereum went “all-in” on the rollup-centric roadmap, by deprioritizing scaling L1 and encouraging all dapps and users to move to rollups. In hindsight, knowing now the issue of rollup fragmentation hindering user experience, and with a recent understanding of a viable L1 scaling strategy, it is clear that the extent to which Ethereum deprioritized the L1 was too high.

It is important to stress that the above understanding is very much in hindsight: rollup-centric roadmap came as a solution to an urgent problem of extremely high onchain fees, and at the time there was no realistic solution in-sight on how to scale L1 — the ideas of access lists and (especially) zkEVM were way too far out. As a result, it was nearly impossible to predict the future and allocated the right amount of research and engineering between L1 and DA.

Furthermore, even though we now have a clear path for raising the L1 gas limit by 100x, some sort of horizontal sharding is eventually unavoidable to scale beyond 10k TPS and realize the full vision of Ethereum as a platform for all public compute. In view of this and the previous paragraph, the rollup-centric roadmap was on balance the right call at the time.

We now present the last, most pronounced reason for why people doubt the rollup-centric roadmap — the main reason for Ethereum’s revenue underperformance up to date.

Factor C. Demand for rollup blockspace has not definitively surpassed the Ethereum DA supply yet. Rollups sequencers package transactions very efficiently when posting them to Ethereum’s DA. In addition, part of this cycle’s user activity was captured by Tron and Solana — especially memecoin trading.

Before the Pectra upgrade in May 7 2025, with 3 blobs per block as the target capacity Ethereum’s DA supply was approximately 210 TPS, and this supply was bigger than the demand until November 2024, as can be observed in Figure 6a. Noting however the blob gas price on Figure 10, we see that after November 2024 demand did not significantly surpass supply, and hence did not push the blob fees to meaningful levels. And after the recent Pectra upgrade which expanded the blob target from 3 to 6 per block, the DA supply was increased and is again bigger than the demand.

Factor C is the underlying critical factor, partially responsible for both Factors A & B. If Factor C is resolved, and the rollup blockspace demand surpasses definitively the Ethereum DA supply, the blob fees would enter price discovery and Ethereum fees would look very different. ***

The upshot is that the Dencun upgrade lowered Ethereum L1 fees considerably, did not result in significant fees on the DA layer, and coincided with the time when serious competition appeared in the blockspace market. These factors explain the drop in Ethereum’s revenue in the beginning of 2024.

The Dencun’s negative impact on fees was expected by many; however, from the business perspective, it was not preemptively communicated that selling cheap DA in the beginning is normal and even preferable, in order to definitively win the rollup market. This caused the market to interpret the significant drop in burned ETH as the sign of Ethereum’s decline of PMF.

The resulting ETH price action left many ETH holders disillusioned, and recently caused major perturbations in Ethereum community, which culminated in change of EF leadership. This change is undoubtedly positive, representing the steady shift of Ethereum Foundation away from (historically necessary and successful) research-heavy careful stewardship entity to a more product-aware proactive group of people who are collectively focused on winning the blockspace market.

So far we have kept the text mostly descriptive; in the remaining part of the piece we offer our perspective on what the future holds for Ethereum, and how we should all collectively shape and accelerate it.

6. The Framework for valuing ETH the asset, and Ethereum’s Business Strategy

ETH the asset. The central question is whether ETH is a productive asset or money. We strongly believe that ETH should be a productive asset first, and money second, for two reasons.

First, because Ethereum’s strongest moats are in technology: most trust and robustness from years of being battle-tested, most neutrality and censorship resistance from decentralization, highest DeFi adoption, highest-quality research and developer ecosystem, strongest liveness properties like handling network partitions, multi-client architecture, etc. It’s the only truly unstoppable World Computer.

Second, because being a productive asset driven by technology adoption can and will reinforce the monetary premium, and not vice-versa. It is true that ETH as money is more likely to survive multiple technological cycles. However, even if aiming to have a strong monetary premium, the easiest path towards that is to successfully deliver Ethereum as a technology platform, and make Ethereum’s economics sustainable. With this strong foundation, monetary premium will emerge naturally. The other way around — meme-ing ETH as money into existence — is a much weaker strategy with no solid foundation to build upon.

The bottom line is that ETH price reflects the discounted future fees captured by the network, the monetary premiums (store-of-value, medium-of-exchange, and maybe eventually unit-of-account), and the speculative premium (which includes memetic and cultural value). While the latter two factors are potentially the most impactful, the strongest path to reinforce all three is to maximize the first one, the foundation — future network’s revenues that will accrue to ETH holders.

The business strategy: differentiate the product, win customers, build moats. How can Ethereum as a network optimize for its future revenue? The product business strategy is critical here — how Ethereum will position and develop its L1 and DA, and how it will capture value?

Ethereum is a technology platform that operates in a highly dynamic and competitive blockspace market, with insane network effects accruing to the winner. Therefore, to maximize its future value, the right strategy is to not extract value prematurely, but instead build superior products, win as many customers as possible (which involves damping the prices at first), and develop strong network effects to grow the market power. The most successful technology networks developed this way.

So what product Ethereum should be selling (L1 blockspace and/or DA?), how it will differentiate it from competitors, and what will be its moats?

The market segmentation and timeline separation between the L1 and DA products of Ethereum. One of the most nontrivial questions currently is what should be the business focus of Ethereum — L1 or rollups? As most people have rightfully observed, the answer is both. However, it is important to delineate between the two market directions, as well as clarify the timelines.

On the one hand, in the short-medium timeframe Ethereum should definitely collect the low-hanging fruits of ability to scale L1 to thousands in TPS — this will allow Ethereum L1 to host the crypto-native DeFi market, accommodate settlement for CeDeFi, as well as uphold censorship resistance and enable interoperobility for L2s.

On the other hand, there are many usecases of public blockspace that involve frequent transactions: payments, trading, AI agent-to-agent coordination, gaming, etc. Payment providers collectively process well over >10k TPS, and are actively building on Ethereum today (most notably Stripe and Visa adopting the rollup rails for stablecoin payments; see ethereumadoption.com for more). These businesses will want to process payments on their own schedule, while periodically settling to the most secure layer through which they can interoperate with the rest of the world — and rollups are the ideal rails to implement this . Hence, to capture the massive long-term demand for blockspace, Ethereum should continue pushing the rollup b2b strategy, offering settlement and data availability on Ethereum. ***

In practice, we have observed several L1 monolith smart contract platform rise, and know exactly theirs moats — they come from the very strong trust, liquidity and composability network effects. Ethereum L1 has seen it’s product market fit, is way ahead of other L1s in terms of security and liquidity — hence the path to scale L1 to thousands of TPS and facilitate demand is relatively clear.

A much more critical question is how Ethereum should facilitate the rollup adoption. In the rest of the text we go into detail of our rollup thesis.

7. The Rollup-centric Long-term Thesis

We now present the central argument for why rollup adoption will grow, and why Ethereum has made the right decision with the rollup-centric long-term roadmap.

Ethereum’s core value proposition. From the technology supply perspective, Ethereum is the most battle-tested and decentralized smart contract platform, hence offering the highest level of security — integrity of execution, liveness & censorship resistance. And Ethereum can extend these security guarantees to rollups, through the validating bridge technology & DA, capturing the financial and Web 3 blockspace demand beyond the L1 capacity.

From the market demand perspective, our core thesis is that long-term users will not know what blockchain they use, but execution will happen on chains with the lowest risk-adjusted transactional costs. By “risk-adjusted” we mean that, in addition to factors like speed & throughput, the costs must account for security. And because it is so hard to bootstrap decentralized networks, the cheapest way to reach the highest levels of security is to be a rollup and buy it from Ethereum — long-term, all rational network businesses & institutions will be pushed towards this market equilibrium, coalescing around Ethereum as a Schelling point.

Furthermore, in order to survive multiple technological waves and transcend generations, Ethereum has to be a platform that other tech companies build on. And not willing to compromise on decentralization & security allows Ethereum to do exactly that — be truly neutral, such that different technological & state actors are willing to coordinate around one Ethereum economic zone. In addition, rollups’ customizability provides the much needed flexibility for existing businesses to adjust to the new crypto paradigm.

This is the optimal scaling architecture — Ethereum acts as the root of trust by providing highest level of security through DA and settlement, while rollups handle latency, throughput, UX and other optimizations.

Ethereum vs Solana. Based on the fee earned in 2024, some may say that Solana has started outcompeting Ethereum in the blockspace market. However, Solana’s hardware-focused scaling strategy is much riskier, and the network shows signs of oversaturation periodically. If blockchains live up to to their full potential—i.e. the whole financial infrastructure largely moves onchain—Solana will need to pivot to the sharding scaling strategy, whereas Ethereum’s security, rollup infrastructure & adoption will be already way ahead.

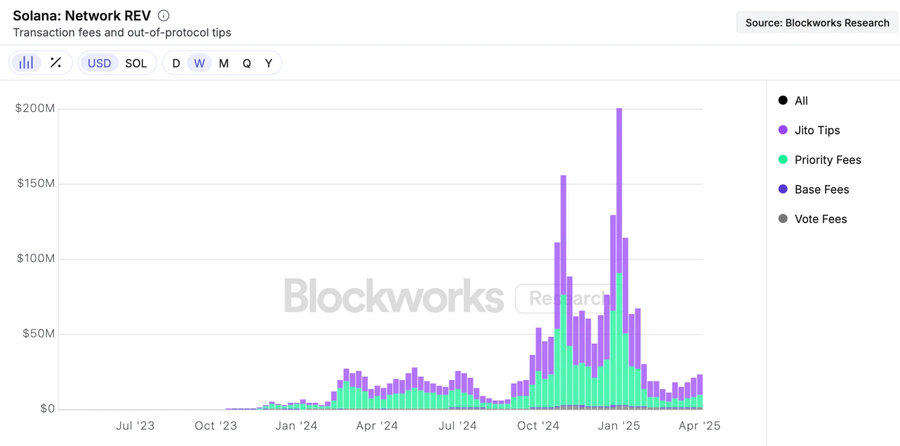

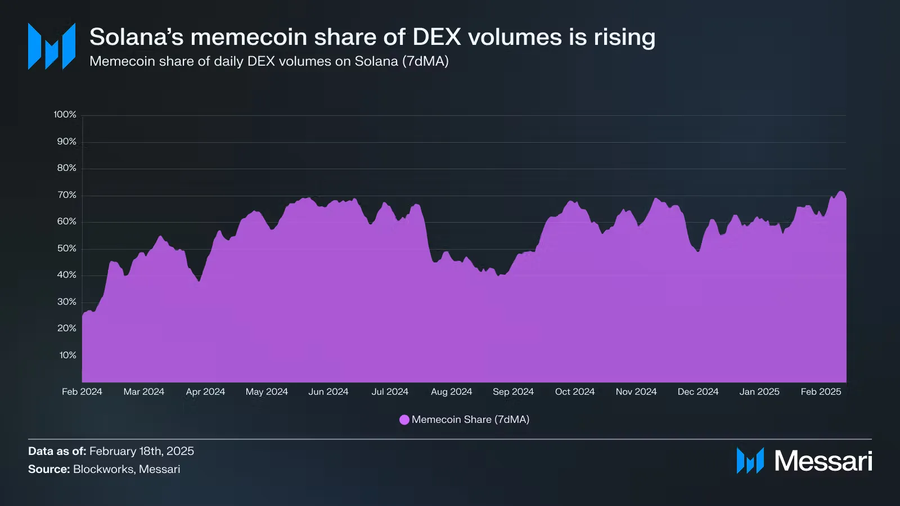

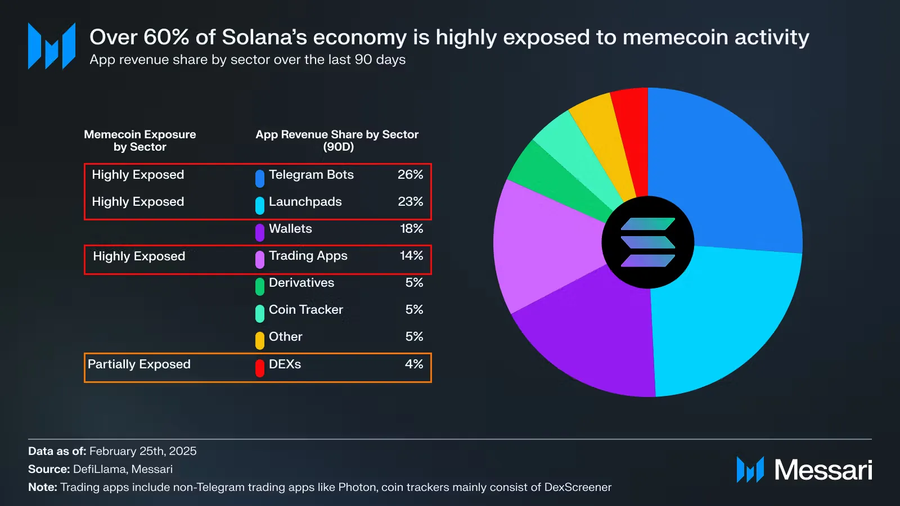

The other problem in comparing Ethereum to Solana is that most of Solana’s 2024 traction came from memecoin trading. Memecoins are an emergent but negative-sum phenomenon — the jury is still out on how sustainable it is, but the latest data suggests that the recent wave of memecoin interest is subsiding, while their share in Solana’s economy is steadily over 50%.

Figure 15: Solana’s revenue

Figure 16a: Memecoin share of Solana DEX volumes

Figure 16b: Memecoin share of Solana’s economy

At last, the most obvious but also the most important difference is in the decentralization level: Ethereum is validated by a diverse set of various entities forming a staking economy of its own, while Solana’s delegated stake is quite centralized.

The head start Ethereum has in its rollup-centric b2b strategy will be the decisive factor in the long race for the blockspace adoption and network effects. This is bolstered by Ethereum’s robust L1 DeFi ecosystem and liquidity:

DeFi adoption. The liquidity coming from DeFi & tokenization is sustainable and sticky. On this front, Ethereum is leading in TVL & stablecoin metrics. Stablecoins are widely considered to be the next step-function improvement in internet economy, making payments borderless. Stablecoins represent most of RWAs today, and are the best proxy to measure proliferation of DeFi into world’s financial system.

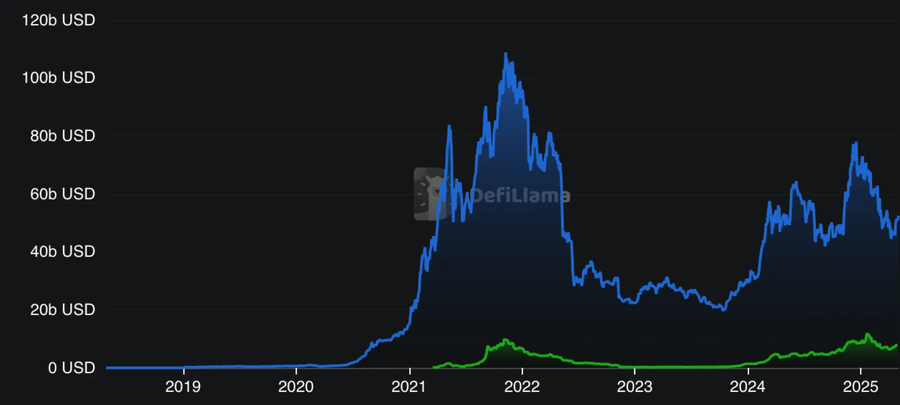

Figure 17: TVL of Ethereum and Solana; see Figure 6b for $38B TVL on rollups

Figure 18: Weekly stablecoin transfer volume on Ethereum, rollups and Solana

The upshot is that Ethereum today, with its security first mindset and existing DeFi ecosystem, is the best place to store value, compared to other alternatives. Even compared to Bitcoin L1, the programmability and interoperobility of the value stored on Ethereum offers a superior platform both for businesses and users.

But then, what is the actual problem with Ethereum’s rollup strategy? If the rollup-centric roadmap is correct, and the long-term future of Ethereum is bright, why has the ETH price action has been so bad?

From the technology perspective, the main downside of the rollup architecture is the absence of default interoperobility, the resulting state fragmentation & severely hampered user and developer experiences. However, there are solutions to this problem, which we discuss in the next section.

More importantly, from the business perspective, a critical problem with Ethereum’s rollup strategy has been the following:

Ethereum does not signal a clear rollup business strategy.1. Short-term adoption: How will Ethereum help drive rollup adoption?2. Long-term moat: Why long-term rollups will not move to alternative DA platforms?

To summarize, here is a diagram of points discussed so far:

We have addressed the L1↔Rollup market separation above: the blockspace market will exceed well beyond 10k TPS, and businesses will want to congregate in one economic zone. As such, Ethereum L1 is well positioned to capture the DeFi, settlement, interoperobility and high-value transaction demand, while rollups are best positioned to capture high-velocity market of payments, AI-to-AI coordination, trading etc — by (a) scaling faster than 3x per year and further than by 100-1000x; and (b) customizing the VM, sequencer, finality and other critical properties of the network.

At last, we offer a detailed analysis of Ethereum’s rollup strategy, and propose a 3-prong approach to help Ethereum successfully drive rollup adoption and build long-term DA moats.

8. The Rollup Business Strategy: expansion, differentiation and moats

I. Ethereum should prioritize expansion, continue offering abundant DA and keep the prices low.

Rationale. Ethereum operates in a highly dynamic and competitive market of technological networks, with major network effects accruing to the winner. In this setup, the right strategy is to offer superior products at cheap, almost vanishing prices — most widely adopted technology networks developed this way

Hence Ethereum DA should stay cheap, keeping the friction for rollups to choose Ethereum’s DA as low as possible. This means that Ethereum played it right (even if by accident) by damping the prices, via offering 3 blobs right after Dencun — supply that was at the time higher than the demand.

Implementation. To understand whether Ethereum will be able to keep DA gas fees low, we analyze the supply & demand dynamics.

Ethereum DA supply today. Ethereum DA supply is approximately 420 TPS, with 6 blobs per block.

Ethereum DA demand today. Ethereum DA demand was capped by 210 TPS supply up until before the Pectra upgrade, and now the TPS is starting to go up and fill the expanded 420 TPS supply. Observing the picture below, we see that demand is composed from ~140 TPS coming from Base, ~90 TPS coming from Arbitrum, Taiko, World Chain, Optimis, Sony’s Soneium and Unichain, and 40 TPS coming from many other rollups.

Figure 19: Composition of rollups' blockspace.

Ethereum DA demand in future. The rollup userbase and TPS are rapidly expanding: Base, for example, recently averages 100 TPS and surging after the Pectra upgrade.

Figure 20: Base TPS.

With current target 35m gas per second, Base plans to expand to 250m gas per second in 2025 (~650 TPS), and eventually reach 1b gas per second target throughout (~2500 TPS). World Chain’s TPS is growing fast as well.

In total, demand could exceed 10k TPS in the foreseeable future: 10000 TPS from 3 breakout institutional or consumer appchains (e.g. payments); 3000TPS from 3 successful general-purpose rollups such as Base, Arbitrum and Optimism; 2000 TPS from 1-2 successful native/based rollups; and 1000 TPS from the long-tail of rollups.

Ethereum DA supply in future. From numbers above it is clear that Ethereum DA—with 420 TPS today—needs to scale blobspace as much as possible & as soon as possible. Fortunately, Ethereum community has long recognized this need, and has the necessary scaling plans in place:

- 3k TPS by end of 2025: for the Fusaka upgrade (Q4 2025), the proposed blob target is 48 per block, enabled by the PeerDAS scaling technology.

- 10k TPS towards end of 2026 / beginning of 2027: the next major scaling upgrade will be 2D PeerDAS, enabling 128 blobs per block.

- 100k TPS eventually: with similar scaling techniques and improvements to data compression.

II. Ethereum should solve the rollup interoperobility issue, and facilitate dapps & wallets to have the best possible UX.

Rationale. Interoperobility is probably the most important missing feature in post-rollup Ethereum, for two reasons.

First, fragmentation has harmed both developer and user experiences. If one wants to build on Ethereum, it is not clear on what rollup they should deploy; if one wants to use Ethereum, it is not clear to what rollup one must connect. Thus it is critical to solve interop — it will allow Ethereum to have a “default” DX and UX, and close the feature gap with integrated blockchains.

Second, interoperobility is the key behind the liquidity moat that we discuss in prong III below.

Implementation. The Ethereum community has recently recognized rollup interoperobility as one of the key problems, and is working hard on developing solutions:

- Sub-second medium-size asset swaps via intents: The intents & solvers ERC-7683 standard enables effective cross-chain asset swaping and bridging, for medium size volumes. Resource-locks collapse the latency of such transactions below one second.

- Sub-hour large asset bridging via Ethereum L1: The idea of rollup finalization via 2-of-3 OP+ZK+TEE offers a clear relatively easy path to fast finality for rollups. This in turn enables market makers and institutions to trustlessly bridge large sums between rollups via Ethereum L1, under an hour.

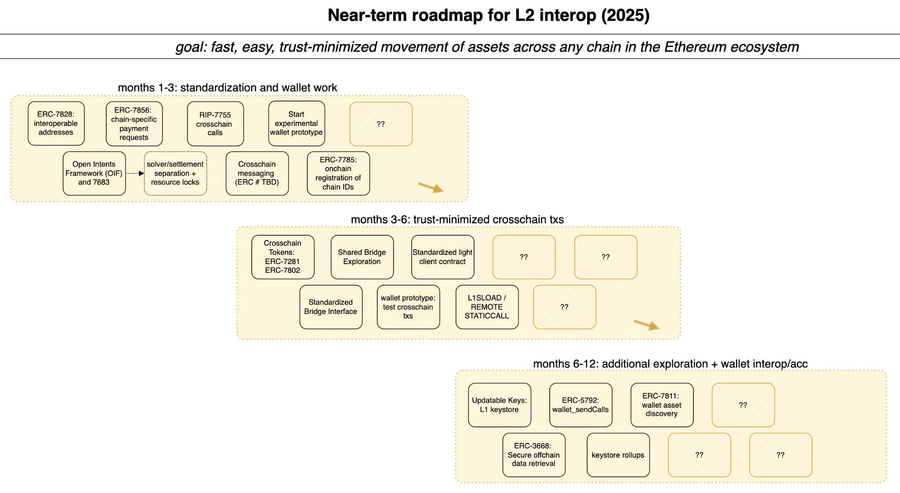

There are also other solutions in development, pointers to which one can find in this post and on the roadmap below:

Figure 21: L2 interop roadmap.

Let us note that we discussed interoperobility as it relates to trustless bridging of liquidity — in our opinion, this covers the vast majority of the market demand. The more powerful synchronous composability and cross-chain function calls are less clearly in demand, and the technologies that enable them (shared sequencing, real-time proving) are in earlier phases of development. In practice, it is likely that dapps will take care of the cross-chain interactions on the back-end, abstracting all the complexity from users via intents — the key for this will be the ability of dapps to freely move liquidity for rebalancing, which circles back to the critical issue of efficient liquidity bridging.

From our perspective, there needs to be even more research and coordination focused on interoperobility.

III. Ethereum should differentiate and build moats for DA.

Rationale. Ethereum should differentiate its DA in order to attract the next marginal rollup business customer, whereas building moats will allow Ethereum to retain rollup customers.

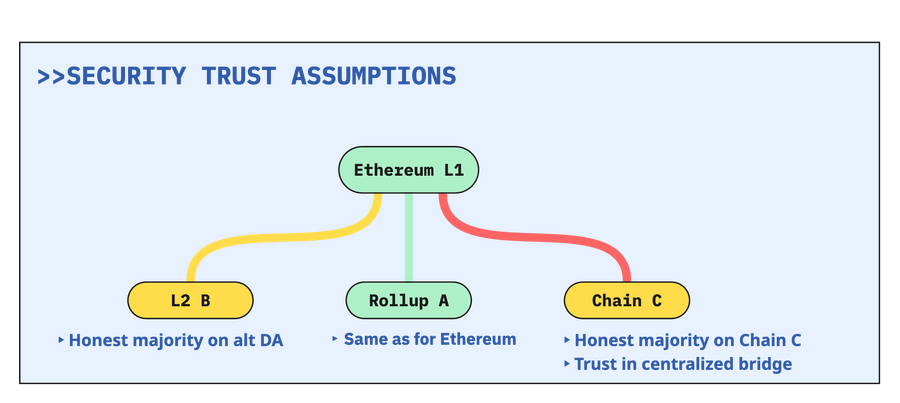

Implementation. For blockchains, and Ethereum in particular, the critical differentiation factors and moats come from three types of network effects: trust, liquidity and composability. As we pointed out above, the demand and feasibility of cross-rollup composability are still not well-understood. Therefore, the bulk of value in cross-rollup network effects is contained in the first two—trust and liquidity—and they transition well from Ethereum L1 to Ethereum+rollups, given interop is solved. Let us discuss this overlooked point in more detail below; we cover both L2s (which only settle on Ethereum and use alternative DA solutions) and rollups (which settle and post transaction data on Ethereum) for illustrative purposes, to highlight where Ethereum DA makes a difference.

1. Trust/security network effects. The differentiation factor in play for L2s is that settling on Ethereum via validating bridge enables matching the security of the bridge with the security of the L2. For rollups, using Ethereum DA gives highest possible security provided by the Ethereum validator set. For separate chains, the bridge effectively becomes centralized, and not secure.

Figure 22: Different trust assumptions for Rollups (use Ethereum for DA & settlement), L2s (use Ethereum for settlement), Chains, and bridges that connect them to Ethereum.

To spell out the trust network effect in play — with each new rollup Ethereum DA becomes more and more battle-tested, and thus the next rollup is more likely to accept that Ethereum DA is the most secure DA on the market. Over time this builds a moat for Ethereum DA.

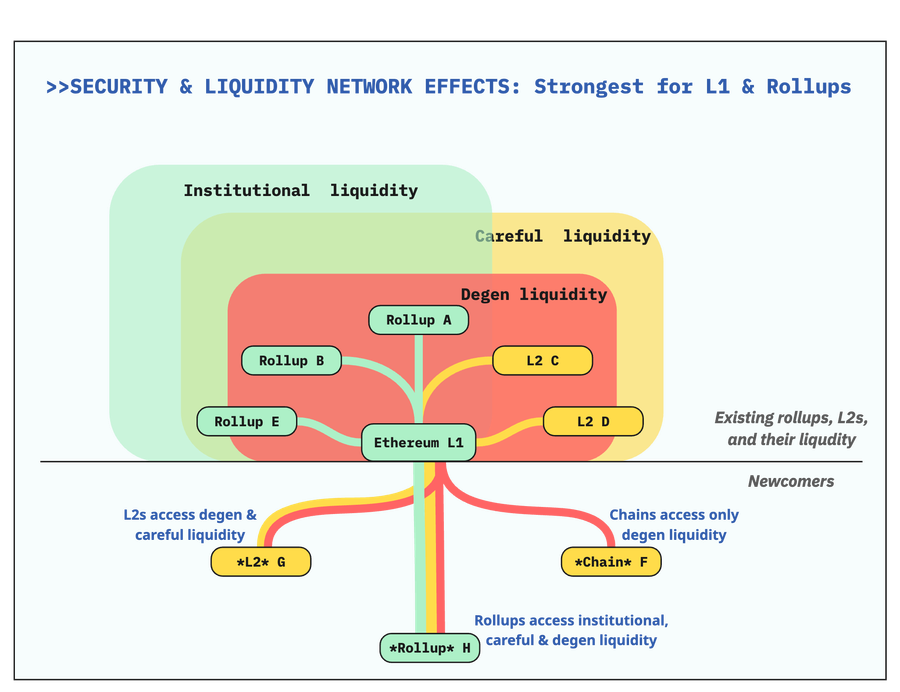

2. Liquidity network effects via interoperobility. In practice, the biggest differentiation factor and network effect for blockchains is liquidity. Before we proceed, let us assume a partition of onchain liquidity on into three buckets: “degen” liquidity that is comfortable with centralized bridges, “careful” liquidity that is not comfortable with centralized bridges, but is fine with operating on other chains and using validating bridges; and “institutional-grade” liquidity which is only comfortable with Ethereum-level security.

Historically, Ethereum L1 liquidity has been one of the main incentives for chains to becomes L2s and rollups — and it makes total sense to reinforce this factor by scaling L1 and solidifying it as the capital of DeFi. The key point, however, is that this dynamic actually extends to liquidity on all the rollups. Namely, for L2s settling on Ethereum via validating bridge enables access to careful liquidity on all L2s, not just L1. For rollups, using Ethereum DA gives access to institutional liquidity on all rollups, not just L1.

Figure 23: Security & liquidity network effects: strongest for rollups.

In other words, with continuous rollup adoption by businesses and institutions, the next marginal risk-averse rollup customer will be looking at total rollup liquidity to tap into, as opposed to only liquidity of Ethereum L1. And to spell out the liquidity network effect in play explicitly — with each new rollup using Ethereum DA, the pool of institutional capital that the next rollup can access increases. Over time this builds a very strong moat for Ethereum DA.

With the above mechanics in mind, the market structure will eventually push rollups to use Ethereum DA, in order to obtain the highest level of security & stability, and in order to access liquidity on other rollups.

That said, we should also constantly strengthen & highlight the two factors above: security & liquidity. In practice, this could take different shapes — one clear directions is for Ethereum to lend brand and trust to rollups & dapps in order to acquire institutional grade customers. This is exactly what Etherealize is facilitating, and the timing couldn’t be better — with the current increased regulatory clarity DeFi is primed to expand and start merging with TradFi.

Another important improvement avenue is native execution on rollups — it supercharges all of the above network effects dramatically, because native rollups push security to its limits: no more multi-sigs, the core execution environment is standardized, and safety guarantees are improved by substituting the complicated OP ( ZK, TEE) prover with Ethereum’s validator set. Notably, the majority of existing rollups expressed their plans to eventually add native execution.

9. Path to Value Accrual

When Ethereum scales its DA to the orders of 1M TPS (via ideas similar to 2D PeerDAS), and truly wins the World Computer market with rollups locked in (voluntarily) on Ethereum DA, Ethereum will generate significant fees. On the L1 side, DeFi and it’s adoption by existing businesses will be the main driver — and it will be strongly bolstered by the rollup adoption. In addition, rollups will pay for interoperobility and settlement.

On the DA side, sustainable economics can be achieved by raising the minimum blob price. One way to do it would be to monitor rollups’ collective revenue, and set the minimal price in such a way that rollups pass a meaningful portion of that to Ethereum. To illustrate how would it look like, let us assume that at in several years rollups capture the CeDeFi payments market, and process around 10k TPS and earn billions per year, while Ethereum DA supply is >10k TPS. The blob gas will not enter price discovery, but charging (burning) a minimum 0.3 cent per DA transaction will bring $1B/year revenue to ETH holders. Capturing further high-velocity markets—social, trading, AI agent-to-agent coordination—will push rollup TPS into 30k TPS range, bringing $10B+ in DA fees to Ethereum with sub-cent transactions.

This revenue structure will depend on ETH price and other factors, so the minimal price will have to be adjusted — we expect the minimal price parameter to be set by social consensus, similar to the gas limit today. In general, more research has to go into the optimal way of pricing blobs: for example the connection to the Ethereum L1 fee market has to be fixed (see this proposal). Further interesting directions include SNARK infrastructure for proof building, aggregation & verification (as Ethereum transitions to zkEVM, and maybe eventually even RISC-V), as well as potential ways DA can help capture fees from valuables transactions on native rollups.

The upshot is that today we shouldn’t think of how to extract value from transactions — instead, we need to facilitate as much as possible the most valuable activity on Ethereum block and blob spaces. This will generate and amplify network effects, and help Ethereum capture the inevitably growing blockspace market, which in turn will make Ethereum economically stronger. From there the path to value accrual is clear.

The Future is Bright

Our core thesis is that Ethereum will be the leader in the blockspace market, will develop strong network effects, and attain significant market power in the future. The path is clear: Ethereum L1 will scale and accommodate DeFi and high-value transactions, while on the rollup front Ethereum will solve interoperobility, restore the liquidity network effects, and build a strong DA moat. This way Ethereum will reinforce the trend of financial businesses & institutions building on L1, and will also capture emerging markets such as onchain AI models, decentralized social & identity, RWAs, etc.

Ethereum will be the programmable value exchange substrate, on top of which the new, cybernetic economy will thrive. Any two agents, AI or human, will be able to permissionlessly coordinate resources in an efficient and transparent way.

We at Cyber are proud to support Ethereum and accelerate this future.

Acknowledgements. We are grateful to Izzy, Dankrad, Josh, K Kulkarni, Gabe, Sam, Ladislaus, Brett, Dogan, Asad, Rico, Vitaly K, Hasu and Dennison for helpful discussions and comments.